Here is an excellent ADU Project Financial Breakdown. Accessory Dwelling Units (ADUs) offer homeowners an excellent way to maximize property value, generate rental income, and provide flexible housing solutions. While the benefits of an ADU are clear, understanding the cost breakdown of building one is essential for making an informed investment decision.

In this blog, we’ll provide a detailed analysis of the costs associated with a 500 sqft Junior ADU build, complete with rental income projections, operating expenses, and key financial metrics. This formula can be applied to projects across Southern California for accurate calculations and investment insights.

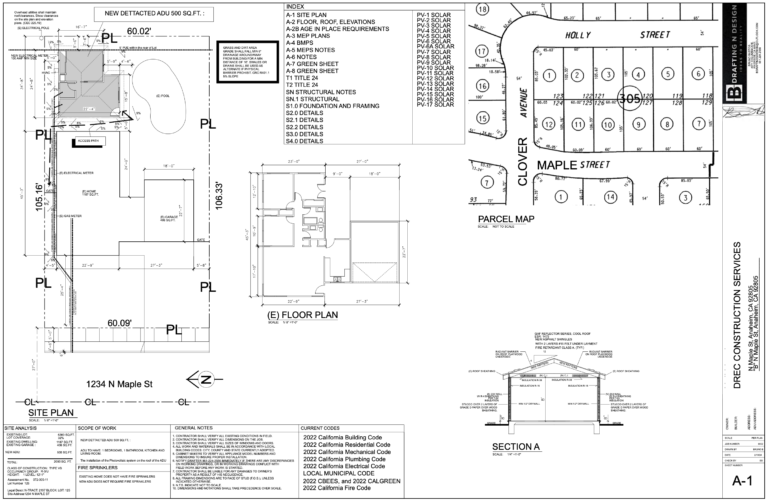

This is a real project on Maple Street in the city of Anaheim – A detached 500-square-foot ADU

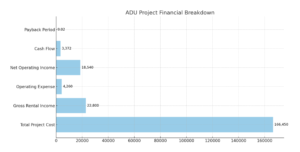

1. Total Project Cost: $166,450

The cost to build a 500 sqft, 1-bedroom, 1-bathroom Junior ADU in Anaheim breaks down as follows:

- Construction Cost: $155,400

- Plan and Engineering Fees: $5,800

- City Permit Fees: $5,250

All-In Total: $166,450

Key Considerations

The total project cost includes materials, labor, design plans, engineering, and city permits. These costs may vary slightly based on location, contractor rates, and material choices. Anaheim offers relatively competitive permit fees compared to neighboring cities, making it an attractive option for ADU construction.

2. Gross Rental Income: $22,800/year

- Monthly Rent: $1,900

- Annual Income: $22,800

Why This Matters

Anaheim’s thriving rental market ensures strong demand for ADUs. With proximity to major attractions like Disneyland and vibrant local amenities, homeowners can command competitive rental rates.

3. Operating Expenses: $4,260/year

Operating an ADU comes with recurring costs. Here’s the breakdown:

- Property Tax (1.2% of the construction cost): $155/month = $1,392/year

- Insurance: $100/month = $1,200/year

- Miscellaneous Expenses (landscaping, cleaning, etc.): $100/month = $1,200/year

Total Operating Expense: $355/month = $4,260/year

Tips to Reduce Expenses

- Bundle property insurance for cost savings.

- Use low-maintenance landscaping to reduce upkeep costs.

- Regularly inspect the ADU to minimize repair costs.

4. Gross Revenue Multiplier (GRM): 7.3

GRM measures the investment’s profitability by dividing the total project cost by gross rental income:

Formula: $166,450 ÷ $22,800 = 7.3 GRM

What This Means

A lower GRM indicates a better investment. The average GRM in Orange County is 14.88, making this ADU a highly valuable and efficient investment opportunity.

5. Net Operating Income (NOI): $18,540/year

NOI is calculated by subtracting operating expenses from gross rental income:

Formula: $22,800 – $4,260 = $18,540 NOI

Why NOI is Important

NOI reflects the true profitability of your ADU. With $18,540 annually, you’ll have a steady income stream that can cover mortgage payments or be reinvested into the property.

6. Capitalization Rate (Cap Rate): 11.1%

The cap rate measures the return on investment based on the total cost of the project:

Formula: $18,540 ÷ $166,450 = 11.1%

Comparison

The median cap rate in Orange County is 4.75%, so this ADU significantly outperforms average real estate investments. A higher cap rate reflects a more lucrative investment.

7. Cash Flow: $3,372/year

Cash flow is calculated by subtracting expenses (mortgage, vacancy rates, and operating costs) from gross rental income:

Formula:

Gross Rental Income ($1,900) – Expenses ($1,619) = $281/month = $3,372/year

Expense Breakdown:

- Mortgage Payment (30-year fixed rate @ 10%): $1,169/month

- Vacancy Allowance (5% of rental income): $95/month

- Operating Expenses: $355/month

Tips to Improve Cash Flow

- Secure a lower interest rate on your mortgage.

- Keep vacancy rates low by targeting long-term tenants.

- Use energy-efficient appliances to lower utility costs for tenants, potentially commanding higher rents.

8. Cash on Cash Return (CoC): 10.1%

CoC evaluates your investment’s cash flow relative to the initial cash investment (20% down payment):

Formula: $3,372 ÷ $33,290 = 10.1%

What This Means

A 10.1% CoC return is highly competitive. Real estate experts typically consider CoC returns of 8-12% to be worthwhile.

9. Payback Period: 9.02 Years

The payback period measures how long it takes to recoup your investment through net operating income:

Formula: $166,450 ÷ $18,540 = 9.02 years

Why This Matters

With a payback period of just over nine years, this ADU is a strong long-term investment. Many real estate projects have payback periods exceeding 15 years, making this project a standout opportunity.

Real-Life Success Story

This Anaheim homeowner built a 500 sqft ADU to generate passive income and offset their mortgage. With $18,540 in annual NOI and a 10.1% CoC return, they’re well on their way to financial freedom. Their ADU remains occupied year-round, thanks to Anaheim’s robust rental demand.

Why Choose The ADU Pro for Your ADU Project

At The ADU Pro, we specialize in helping homeowners maximize their investment potential through expertly designed and built ADUs.

What Sets Us Apart

- Comprehensive Project Management: We handle everything from permitting to construction, ensuring a seamless experience.

- Custom Design Solutions: Tailored ADUs that meet your specific needs and maximize rental appeal.

- Proven Track Record: Numerous satisfied clients across Anaheim and Southern California.

What Our Clients Say

⭐️⭐️⭐️⭐️⭐️

“The ADU Pro made the entire process stress-free. Our ADU rents out for $2,000/month, and we couldn’t be happier!”

– Lisa M., Anaheim

⭐️⭐️⭐️⭐️⭐️

“The ADU Pro team delivered beyond expectations. Our 1-bedroom ADU has been a game-changer for our finances.”

– Mark R., Orange County

Ready to Build Your ADU?

If you’re considering an ADU project, let The ADU Pro guide you every step of the way. We’ll help you maximize your investment and create a space that tenants will love.

📞 Call us at (877) 398-8002

🌐 Visit us at www.theadupro.com

Start your journey toward financial freedom with a profitable ADU investment today!

If you would like more information, call or text (877) 398-8002 or Click here for more information

Looking to find help financing your ADU? Click Here

www.primarymortgageresource.com